A Brief History of Berkshire's Apple Investment

"Probably the best business I know in the world" -Warren Buffett

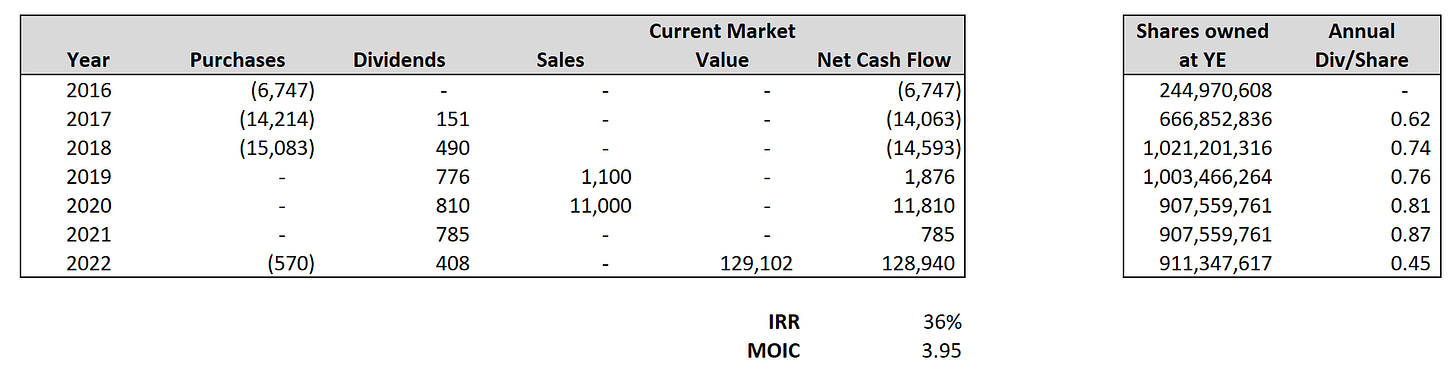

In 2016, Berkshire Hathaway began purchasing Apple shares - lots of it: $6.7B in 2016, $14.2B in 2017, and then $15.1B in 2018, quickly turning it into their #1 equity holding. According to this Business Insider article by Theron Mohamed, the initial purchases were made by Ted Weschler; Warren Buffett began buying after he saw how devastated Sandy Gottesman, his friend and a Berkshire Hathaway director, was upon losing his iPhone. In total, Berkshire spent $36B for 1.02B shares (split-adjusted) - about $35 per share.

Berkshire trimmed some shares in Q4 2019 (~$65-$70/share), then sold a large chunk of shares in Q3 and Q4 2020 (~$110-$120/share). At the 2021 annual shareholder meeting, Buffett said that selling was probably a mistake (and that Charle Munger told him so). At the 2022 shareholder meeting, Buffett revealed that they actually began buying Apple shares again in Q1 (~$150/share).

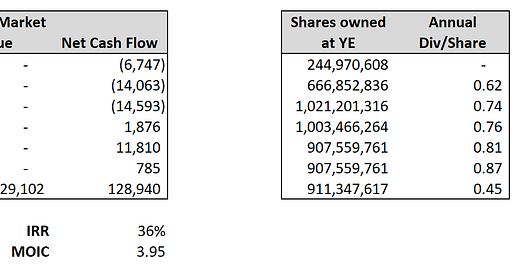

Below, I’ve estimated Berkshire’s IRR and MOIC on its Apple investment, as of 6/24/2022. The numbers are not meant to be perfect (“it’s better to be approximately right than precisely wrong”) - for instance, dividends are slightly understated (for ease of calculation).

An IRR of 36% and a MOIC of 3.95 on a $36B investment is simply incredible. Don’t forget that by being housed within Berkshire, a portion of the investment was funded by zero-cost insurance float, so in actuality the return is even better.

The 2022 purchases are super interesting to me - Buffett rarely seems to pay above 10x earnings for even the best businesses (e.g. the initial Apple purchases), and yet here he is paying around 20x. To get a 10% annual return from here, one must assume three things:

Apple pays out 100% of earnings, so investors get 5% annually from dividends plus share count reduction

The earnings multiple does not contract

Earnings grow 5% annually over the long term

Assumptions 1 and 2 appear likely to me - assumption 3 is more difficult, as Apple’s earnings power is already over $100B. However, demand for Apple’s products is very price inelastic, so they should be able to keep raising prices (and thus increase earnings with zero incremental capital). There is also capacity to expand internationally, continue growing services, and spawn new businesses (VR, Apple Car, etc.). It’s also possible that Buffett is using a discount rate lower than 10%.

One more note on the recent purchases: Berkshire bought shares around $150, which is over 4x their initial purchase price and about 30% higher than the price at which they trimmed in late 2020. For most investors, anchoring bias would make this a difficult thing to do. For Warren Buffett, the past is the past, and the only thing that matters is the future.