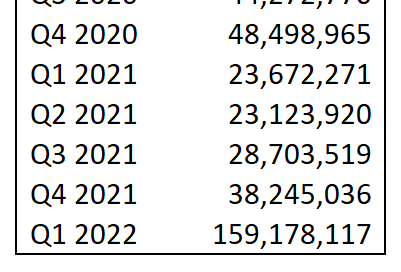

The path to Berkshire’s current Chevron stake has been peculiar. They initiated the position in Q3 of 2020 - normally it would have shown up in the November 2020 13F, but that quarter the SEC granted Berkshire confidentiality for a few positions that they were building. In February 2021, the confidential positions were revealed to be Chevron, Verizon, and Marsh & McLennan. Since then, the number of Chevron shares held has changed every single quarter:

I estimate that the Q3-Q4 2020 purchases occurred around $83 per share, and that the subsequent selling in Q1-Q2 2021 occurred around $100-105 per share. The Q3 2021 purchases were probably around $100, with the Q4 2021 purchases around $115. Then in Q1 2022, Berkshire really ramped up the buying, turning it into their 4th largest holding as of 3/31/2022 - using clues from the annual meeting regarding timing, I think the average purchase price was around $150-155. It’s likely that Berkshire has bought a lot more shares in Q2.

Obviously, the investment is too early in its life for me to estimate IRR and MOIC. However, I can theorize the primary reason for Berkshire upping its bet so heavily in Q1: Russia’s invasion of Ukraine. Per the U.S. Energy Information Administration, Russia produced 10.1 million barrels of crude oil per day in 2021 - 13% of the world’s total of 77.1 million per day. The prospect of embargos by Western countries against Russian oil means that a large chunk of supply will become unavailable to them, creating demand-supply imbalances. Thus, unless production by non-Russian countries ramps up (which can take years) or demand comes down, higher prices are necessary to restore the balance.

At this point I’ve begun to stray into areas I know very little about, so I will return to Chevron’s financials. At $150 per share, Chevron’s diluted market cap is roughly $300 billion. They pay an $11 billion dividend annually and intend to repurchase $10 billion annually. CEO Mike Wirth says that this repurchase rate is set at a level that Chevron will be able to maintain throughout the commodity cycle. So, between dividends and buybacks, Chevron has about a 7% shareholder yield ($21 billion/$300 billion).

However, this still leaves a lot of free cash flow on the table. In Q1, Chevron did $7 billion of free cash flow (excluding working capital changes), but this was with an average sales price per barrel of $77 in the U.S. Upstream segment. Assuming similar prices and production levels, Chevron would do around $28 billion of FCF annually. However, crude oil futures currently have a front-month price of ~$105 and don’t anticipate prices to fall under $77 until mid-2024. In addition, Chevron is planning on increasing production over time, particularly in the Permian basin. Furthermore, Chevron’s net debt is quite low in relation to their fixed assets and earnings power - in fact, management has stated their intention to re-lever over time. For these three reasons, I think management is being conservative in setting their buyback at $10 billion annually.

I can see why Warren Buffett likes it, even after the big run-up this year. Management seems to be pursuing a rational balance of dividends, buybacks, and growth CapEx (both for increased oil production and for clean energy initiatives). The valuation looks reasonable, as Chevron trades around or below 10x what I believe it will generate in annual FCF in the coming years (with most of that flowing to shareholders). I suppose the biggest risk to the investment is if the world goes through its transition to electric vehicles much more quickly than anticipated - however, in such a scenario, Berkshire Hathaway Energy would benefit, as well as BYD (a Berkshire investment I will write up in the coming weeks).